Financial planning for entrepreneurs is not merely a spreadsheet exercise; it is a strategic discipline that helps founders endure uncertainty, seize opportunities, define risk tolerances, coordinate teams across functions, and scale responsibly from day one. In practice, success hinges on aligning cash flow management for startups with clear funding options for entrepreneurs, a rhythm that keeps runway intact while supporting prudent growth through disciplined vendor terms, staged hires, and transparent reporting, without compromising customer value or long-term profitability. A practical approach blends cash flow forecast for small business scenarios with budgeting for entrepreneurs, so every decision rests on realistic, testable assumptions, enabling scenario planning, risk assessment, and what-if analyses that inform pricing, product choices, and capital allocation. This guide translates big ideas into actionable steps—forecasting, scenario planning, governance, and disciplined spending—while outlining startup financing strategies, equity-versus-debt tradeoffs, and governance practices that sustain momentum without sacrificing control. If you’re building a company from concept to scalable operation, a disciplined financial plan should guide decisions at every growth milestone, from product development timelines to hiring ramps and market-entry bets.

Viewed through an alternative lens, this discipline becomes an entrepreneurial financial roadmap that synchronizes liquidity, capital allocation, and growth milestones without overburdening the team. Instead of treating forecasting as a standalone task, it becomes strategic capital planning that maps how cash inflows align with expenditures, hiring, product development, and market entry. Governance, dashboards, and staged funding models translate risk management into everyday decisions about vendor terms, milestone-based releases, and governance rights. By speaking in terms like cash runway optimization, capital structure choices, and profitability trajectories, you communicate credibility to partners and investors while preserving the agility to pivot when needed.

Financial planning for entrepreneurs: A disciplined roadmap to sustainable growth

Financial planning for entrepreneurs is not a one-off spreadsheet; it is a continuous discipline that translates strategy into cash reality. By weaving forecasting, budgeting, and governance together, founders can anticipate shortages, time investments, and seize opportunities with confidence. When cash flow is treated as the nervous system of the business, every major decision—from product launches to hiring—takes into account how liquidity will behave across time.

To execute this effectively, build a realistic financial model that links unit economics and margins to a credible cash flow forecast for small business. Regularly refresh a 12–18 month plan, run scenario analyses (base, downside, upside), and connect financing needs to the timing of milestones. This alignment between cash flow management for startups and a governance framework reduces burn-rate risk while preserving optionality for growth.

Mastering cash flow and funding: practical steps for startups

A strong operating rhythm starts with cash flow management for startups. Create a transparent 12–18 month cash flow forecast, incorporate seasonality, payment terms, and expected collections, and update it monthly. This visibility helps you spot runway risks before they become emergencies and strengthens your conversations with investors and lenders.

Budgeting for entrepreneurs becomes actionable when it’s tied to the product roadmap and capital needs. Implement rolling forecasts, allocate cost centers by function, and add contingency buffers so you can adjust quickly without sacrificing growth. When you compare actuals to plan, you gain insight into what drives cash needs and where funding options for entrepreneurs should come into play.

Finally, explore startup financing strategies that fit your stage, whether bootstrapping, angel investment, debt facilities, or venture funding. A disciplined approach aligns the funding mix with your forecast, preserves equity where possible, and keeps governance tight so you can meet milestones on schedule.

Frequently Asked Questions

What is financial planning for entrepreneurs and why is it critical for cash flow management for startups?

Financial planning for entrepreneurs is the strategic process of turning ambitious plans into a credible financing blueprint that harmonizes cash flow management for startups, budgeting for entrepreneurs, and growth priorities. It begins with a realistic cash flow forecast for small business (12–18 months) and rolling updates to expose runway gaps and funding needs. By combining robust revenue modeling, cost discipline, and a clear set of startup financing strategies, the plan strengthens your position with lenders and investors while guiding prudent expansion. In short, this discipline helps founders endure uncertainty, seize opportunities, and scale responsibly.

How do I implement budgeting for entrepreneurs and evaluate funding options for entrepreneurs within a financial planning for entrepreneurs framework?

To implement budgeting for entrepreneurs and evaluate funding options for entrepreneurs within a financial planning for entrepreneurs framework, start with a single source of truth financial model that ties revenue, costs, headcount, and capex to strategic milestones. Build a budgeting for entrepreneurs process with top-down revenue targets, detailed cost centers, and contingency buffers, and pair it with a cash flow forecast for small business covering 12–18 months. Then assess funding options for entrepreneurs—bootstrapping, debt, angel or VC funding, grants, and others—against your runway, milestones, and governance needs, ensuring you maintain control and clarity. Finally, establish rolling forecasts and variance analysis to adapt the plan as market conditions change.

| Area | Key Points |

|---|---|

| Purpose and scope | Financial planning blends strategy with discipline, translates strategic plans into a realistic financing plan, and aligns cash needs with funding sources to weather uncertainty. |

| Core pillars | Cash flow management for startups; budgeting for entrepreneurs; revenue modeling and cost control; funding strategy; governance and controls. |

| Cash flow | Create a 12–18 month cash flow forecast with opening balance, inflows, outflows, working capital adjustments, and financing activities; incorporate scenario planning. |

| Budgeting and cost discipline | Develop a living budget linked to product roadmaps and hiring plans; use rolling forecasts and variance analysis; include capital expenditure planning and contingency buffers. |

| Funding options | Bootstrapping, friends and family, angels, venture capital, debt financing, grants, and crowdfunding; evaluate cost of capital, governance implications, and impact on runway. |

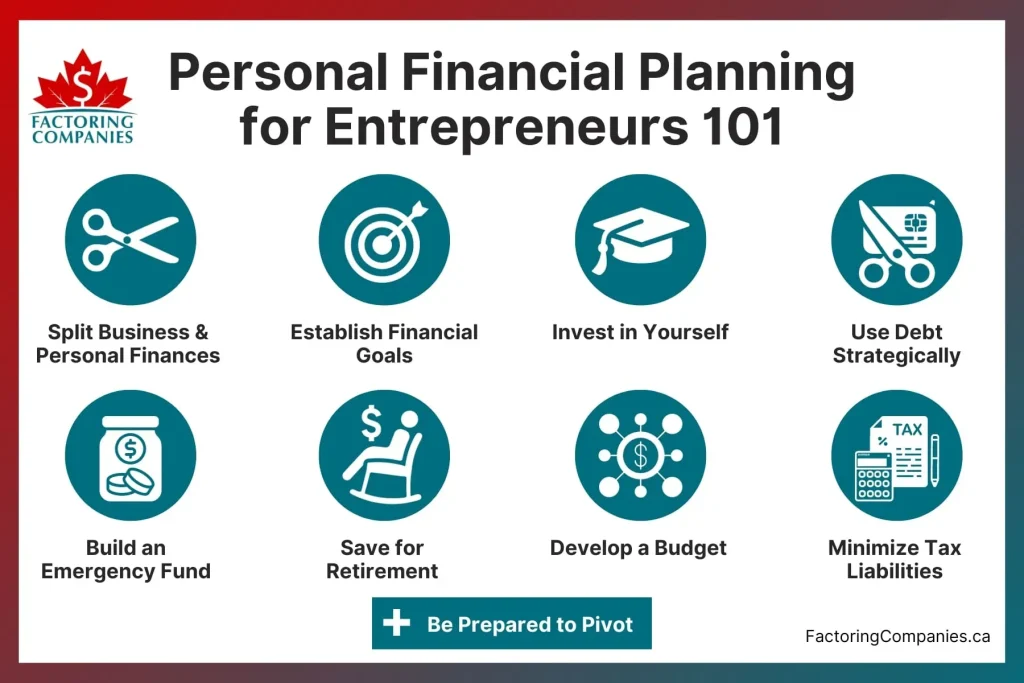

| Practical tips | Single source of truth, separate personal and business finances, dashboards, appropriate tools, and scalable governance to protect assets and ensure accurate reporting. |

| Integrating the plan | Regularly review forecasts, adjust assumptions, and align funding with growth milestones to maintain a credible path to liquidity and scale. |

Summary

Financial planning for entrepreneurs is a disciplined, ongoing practice that combines precise cash flow forecasting, thoughtful budgeting, prudent funding decisions, and scalable governance to create a foundation for sustainable growth. By prioritizing cash flow as the decisive metric, entrepreneurs can optimize working capital, time investments, and attract the right partners. Start by building a reliable cash flow forecast, align your budget with the product roadmap, and craft a funding plan that supports your growth objectives, turning ambitious goals into measurable outcomes.