The Nvidia AI boom marks a transformative chapter in the tech world, positioning the company as a dominant force in artificial intelligence. With its recent approval to sell AI chips in China, Nvidia is experiencing a surge in stock prices, reflecting its pivotal role as an AI technology leader. This surge is part of a larger trend, as Nvidia’s market cap recently soared to an unprecedented $4 trillion, making it the world’s most valuable company. As investors flock to capitalize on the advancements in AI, Nvidia’s innovative chips are at the forefront of this revolution, reinforcing the company’s competitive edge against rivals. Amidst increasing competition in AI, Nvidia continues to set the standard in chip production, driving innovations that promise to reshape various industries.

Nvidia’s emergence as a powerhouse in artificial intelligence can be seen through various lenses, particularly as the frontrunner in AI technology advancements. The company has captured the attention of investors and tech enthusiasts alike, due to its significant growth in market valuation and stock performance. By providing cutting-edge chips that accelerate data processing for applications ranging from chatbots to autonomous vehicles, Nvidia is not only enhancing operational efficiencies but is also solidifying its role as a key player in the tech landscape. The ongoing competition in the AI arena, coupled with Nvidia’s robust portfolio, positions it uniquely to lead the charge in innovation, adapting to the ever-evolving demands of the technology sector. With an evolving market driven by AI investments, Nvidia’s influence is poised to expand even further, leaving potential competitors striving to catch up.

The Rise of Nvidia Stock Prices Amid AI Boom

Nvidia’s stock prices have soared dramatically over the past few years, particularly in response to the burgeoning artificial intelligence market. As an AI technology leader, Nvidia reported a remarkable 69% increase in sales in its fiscal first quarter compared to the previous year, propelling its stock value upwards. Investors have become increasingly bullish on Nvidia as it begins to dominate the AI landscape, with shares rising over 30% in the last twelve months alone. This upward trajectory in stock prices has made Nvidia one of the most valuable companies in the world, surpassing landmarks such as a $4 trillion market capitalization.

The continued rise in Nvidia stock prices reflects not just investor confidence but also the underlying demand for AI technology. As companies scramble to integrate AI into their business models, they turn to Nvidia’s cutting-edge chips. These chips not only power AI applications but are also integral to supercomputers, further enhancing their relevance in a tech-driven market. Nvidia’s ability to provide solutions that cater to the complexities of AI workloads has positioned it uniquely against competitors, ensuring a sustained increase in stock value as demand for AI technology becomes quintessential.

Nvidia: The AI Technology Leader

As the leading provider of AI-specific hardware, Nvidia has established itself as the industry’s foremost innovator, capturing significant market share. The versatility of Nvidia chips allows them to serve a wide range of applications — from generative AI models like ChatGPT to autonomous driving solutions. This diversification strengthens Nvidia’s position not only as a tech titan but also as a crucial player driving advancements in AI technology. The company’s emphasis on research and development has paved the way for breakthroughs that keep it at the forefront of the industry.

Moreover, Nvidia’s influence can be seen in its partnerships and collaborations with various tech firms aiming to leverage AI capabilities. These alliances have enhanced Nvidia’s reputation as an AI technology leader, fostering an ecosystem where businesses can easily adopt AI solutions. The competition has noticed this trend, leading to strategic moves from rivals, including investments and innovation in AI to catch up with Nvidia’s advancements. As a result, Nvidia’s commitment to innovation not only solidifies its standing as a leader but also stimulates competitive growth within the tech sector.

Nvidia’s Market Cap and Competition Dynamics

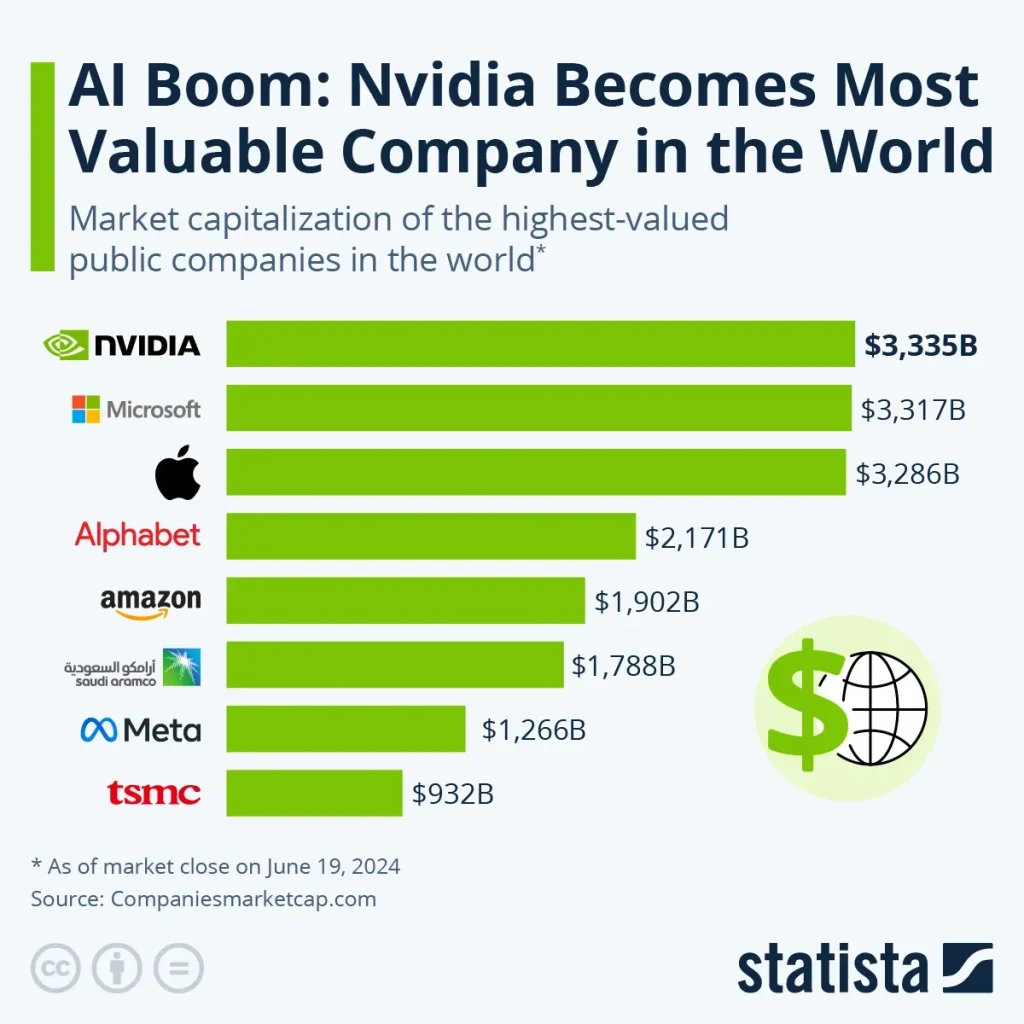

Nvidia’s market cap climbing to $4 trillion is not merely a milestone but a significant shift that has redefined competition in the AI sphere. With this valuation, Nvidia has outpaced not only tech giants like Apple and Microsoft but has also set a benchmark for emerging startups aiming for similar ambitions. As noted by analysts, reaching such a valuation escalates competitive pressures, prompting rivals to accelerate their own innovations in AI technology. Companies are now keenly aware that to remain relevant, they must develop robust alternatives to Nvidia’s offerings or risk falling behind.

The competitive landscape surrounding Nvidia illustrates a dynamic where companies are investing significantly to bridge the gap. While Nvidia currently enjoys a lead in the AI chips market, rivals such as Advanced Micro Devices Inc. are intensifying their efforts to introduce compelling technology that challenges Nvidia’s dominance. Nonetheless, Nvidia’s established position as a reliable chip provider for AI—particularly with its operational insights and market knowledge—offers it a competitive edge that is not easily replicable. The race is on, and while Nvidia may hold the title of market leader, the industry is ripe with opportunities for innovation that could reshape the competition.

Nvidia Chips: Powering the AI Revolution

Nvidia chips have become synonymous with high-performance computing in the AI sector, fueling a wide array of applications that are revolutionizing industries. The company’s investments in developing powerful chips tailored for AI workloads have made it an essential partner for businesses looking to harness machine learning capabilities. Nvidia’s architecture is strategically designed to handle the complex computations that modern AI algorithms require, positioning their products as indispensable for companies aiming to lead in the era of AI innovation.

These chips not only support existing technologies but are at the forefront of new solutions, driving advancements in areas such as natural language processing and computer vision. As these technologies become more integrated into everyday applications, the demand for Nvidia chips continues to rise. This reinforces Nvidia’s standing as the preferred choice for tech firms and highlights its critical role in shaping the future of AI technology. With every new generation of chips, Nvidia further entrenches itself as a leader in the AI space, ensuring its products remain relevant as the technology evolves.

Navigating Competition: How Nvidia Stays Ahead

In the ever-evolving landscape of AI technology, Nvidia faces fierce competition from various players in the industry. Despite this, the company has developed robust strategies to maintain its market position. By consistently innovating and improving its chip technology, Nvidia has crafted a portfolio that meets the diverse needs of AI applications ranging from data centers to consumer electronics. This focus on innovation, combined with strategic partnerships and collaborations, keeps it ahead of competitors who are still trying to catch up.

Furthermore, Nvidia’s proactive approach towards addressing market changes, such as geopolitical tensions and trade regulations, positions it well for long-term success. The company’s ability to adapt swiftly to external challenges—like chip sales restrictions in certain regions—has allowed it to sustain its growth and profitability. Analysts suggest that if Nvidia continues to navigate these hurdles effectively while focusing on expanding its product offerings, it will solidify its competitive advantage in the AI market.

The Impact of AI Technology on Nvidia’s Growth

AI technology’s rapid evolution has had a profound impact on Nvidia’s growth trajectory. As the demand for advanced AI solutions surges, Nvidia has been able to leverage its leading products to capture significant market share. From training artificial intelligence systems to powering supercomputers, Nvidia chips have become the backbone of many AI initiatives across various sectors, illustrating the intertwining relationship between AI advancements and Nvidia’s expansion. As businesses increasingly rely on AI to enhance operations, Nvidia stands to benefit immensely from this trend.

Moreover, the company’s growth isn’t just tied to hardware sales; it also capitalizes on the burgeoning services market associated with AI technology. By offering tailored solutions and software that run on its chips, Nvidia has positioned itself not only as a chip manufacturer but as a comprehensive AI technology provider. This approach has amplified revenue streams, creating a robust ecosystem around Nvidia products. Such strategies ensure that as AI technology continues to advance, Nvidia remains at the center of the innovation and investment landscape.

A Look at Nvidia’s Financial Performance

Nvidia’s financial performance is a testament to its success in the AI domain. The company reported a staggering increase in net income, reflecting a 26% rise year-on-year, and almost doubled its previous fiscal year’s revenue, underscoring the strong correlation between AI demand and its financial health. Investors and analysts are taking note of these figures, emphasizing Nvidia’s continued growth potential as it rides the wave of the global AI boom. This financial strength not only instills confidence in shareholders but also attracts new investors eager to capitalize on Nvidia’s success.

Furthermore, Nvidia’s ability to adapt its business model to accommodate the explosive growth of AI technology positions it for sustained profitability. Its revenue from AI technologies is forecasted to grow exponentially, thanks to both domestic and global demand. As Nvidia continues to innovate and push the boundaries of what’s possible with AI chips, its financial metrics will likely follow suit, further solidifying its status as a market leader and a key player in the tech industry.

Global Influence of Nvidia’s Technology

Nvidia’s technology has had a significant global influence, especially in the realm of artificial intelligence, where its chips are key components in the development of cutting-edge applications. As businesses worldwide continue to explore AI’s potential, Nvidia serves as a crucial enabler by providing the necessary hardware that supports a multitude of AI-driven innovations. This widespread adoption of Nvidia technology is drawing attention from not only tech giants but also smaller companies eager to integrate AI into their operations.

Moreover, Nvidia’s global footprint allows it to impact various sectors, from healthcare to finance, where AI is being utilized to improve processes and decision-making. By equipping businesses with the necessary tools to harness AI, Nvidia is helping to shape the future of industry practices worldwide. The company’s commitment to innovation and expanding its technologies reinforces its pivotal role in driving global advancements in AI, establishing a legacy of influence that reaches beyond just computing.

Future Prospects: Nvidia’s Path Forward

Looking ahead, the future prospects for Nvidia appear promising as the demand for AI technology continues to grow worldwide. Analysts predict that Nvidia could reach a market cap of $5 trillion, highlighting the immense potential for continued growth in the coming years. Despite competitive pressures and market challenges, Nvidia’s stronghold in the AI sector positions it well to capitalize on emerging opportunities and further entrench its dominance in the industry.

Furthermore, as AI becomes increasingly integrated into daily life, Nvidia stands at the helm of this technological transformation, poised to lead the next wave of innovation. With ongoing investments in research and development, Nvidia is likely to continue producing breakthrough technologies that cater to the evolving needs of AI applications. As it navigates the challenges of the competitive landscape, Nvidia’s ability to adapt and innovate will be critical to maintaining its position as a leader in the AI revolution.

Frequently Asked Questions

How has the Nvidia AI boom affected Nvidia stock prices recently?

The Nvidia AI boom has significantly impacted Nvidia stock prices, which recently rose by 4% to $170.70 per share after the company received U.S. government approval to sell AI chips in China. This reflects the high investor interest in Nvidia as a leader in the AI technology sector.

What is the significance of Nvidia’s market cap in relation to the AI boom?

Nvidia’s market cap reached a historic milestone of $4 trillion, making it the first publicly traded company to achieve this level. This valuation underscores Nvidia’s dominant position in the AI boom and increases competition within the AI technology landscape.

Why are Nvidia chips vital for the advancement of AI technology?

Nvidia chips are essential for the advancement of AI technology as they power a majority of AI applications, including supercomputers and chatbots like OpenAI’s ChatGPT. Their ability to process complex data efficiently makes them invaluable for AI development.

What competitive challenges does Nvidia face in the AI market?

Nvidia faces competitive challenges from emerging companies and established tech giants like Apple and Intel, who have been slower to innovate in AI. Additionally, geopolitical issues and trade wars could impact Nvidia’s operations and market share.

What are the implications of the Nvidia AI boom for future tech investments?

The Nvidia AI boom indicates a trend toward significant investments in AI technology, suggesting that companies will seek efficient solutions to complex problems. Nvidia is seen as a key player in this space, attracting investors looking to capitalize on AI advancements.

How does Nvidia maintain its dominance in the AI sector amid rising competition?

Nvidia maintains its dominance in the AI sector by continually innovating its chip technology and capitalizing on its established market position. Despite rising competition, its significant lead in AI infrastructure is believed to be a barrier to entry for new players.

What role does Nvidia play in powering supercomputers for AI applications?

Nvidia powers over 75% of the supercomputers in the TOP500 list, which ranks the most powerful systems globally. This immense contribution to supercomputing illustrates Nvidia’s central role in enabling advanced AI research and applications.

How has Nvidia’s financial performance changed with the AI boom?

Nvidia’s financial performance has surged due to the AI boom, with sales increasing by 69% to $44.1 billion in its first fiscal quarter. The company’s net income also rose significantly, indicating strong market demand for its AI-related products.

| Key Points |

|---|

| Nvidia is the most valuable company, benefiting greatly from the AI boom. |

| The U.S. government approved Nvidia to sell AI chips in China, leading to a 4% stock increase. |

| Nvidia became the first public company to reach a $4 trillion market cap. |

| Over 75% of supercomputers listed in the TOP500 are powered by Nvidia. |

| Sales grew by 69% to $44.1 billion in the last fiscal quarter. |

| Significant net income increases: $18.8 billion, up 26% year-over-year. |

| Nvidia faces potential challenges from competitors and geopolitical tensions. |

| Analysts anticipate Nvidia could reach a $5 trillion market cap within 18 months. |

Summary

The Nvidia AI boom marks a significant shift in the technology landscape, establishing Nvidia as a leader in the artificial intelligence sector. With its impressive market growth, surpassing tech giants, and commanding a substantial share of supercomputers, Nvidia is positioned advantageously as AI continues to evolve. As competitors strive to catch up amidst geopolitical challenges, Nvidia’s lead seems secure, underscoring its pivotal role in shaping the future of AI technology.