Venture capital defense tech has become an increasingly critical area of investment in the Greater Los Angeles region, attracting significant funding amidst rising global tensions. In the second quarter alone, venture capital investments surged to $5.8 billion, with a notable emphasis on defense technology investments and aerospace companies. Leading the charge is Costa Mesa-based Anduril, which recently secured a staggering $2.5 billion funding round, showcasing the lucrative potential investors see in this sector. The emphasis on technological advancements within defense systems aligns well with the region’s rich history of military innovation, setting the stage for Southern California startups to thrive. As venture capital continues to flow into this space, the landscape of defense tech is poised for substantial transformation, echoed by the growing number of startups entering the field.

The dynamic field of military venture financing has gained momentum as investors shift their focus toward advanced defense technologies and aerospace innovations. In the vibrant landscape of Southern California, where tech startups are flourishing, firms like Anduril exemplify how capital allocation is reshaping the future of defense solutions. With record-breaking funding rounds, businesses are not only enhancing their product lines but also establishing a collaborative ecosystem that includes both commercial and governmental sectors. This convergence of innovation and investment is stirring interest among various stakeholders, signaling a transformative era for defense technology. As these entrepreneurial ventures address the unique demands of modern warfare, the region stands as a beacon of opportunity for aerospace companies seeking funding and new partnerships.

The Rise of Venture Capital in Defense Technology

Venture capital investments in defense technology have seen a remarkable surge, especially in Southern California, where the industry has benefitted from heightened geopolitical tensions. With a staggering total of $5.8 billion invested in the Greater Los Angeles area in the second quarter alone, it is evident that investors are redirecting their focus toward defense technology and aerospace startups. This trend is not only a reflection of the evolving global landscape but also the growing recognition of the need for innovative solutions in defense systems. Companies like Anduril have capitalized on this momentum, attracting significant funding to enhance and expand their capabilities.

As defense technology becomes increasingly critical, the influx of venture capital is likely to continue, drawing more attention to emerging firms capable of developing cutting-edge solutions. Furthermore, the robust government support for defense initiatives has created fertile ground for startups. Investors are now more willing to engage in this sector, recognizing the potential for significant disruptiveness that new technologies can bring to traditional defense contracting giants.

Investor Interest in Aerospace Companies Funding

Southern California’s rich history in aerospace innovation has made it a focal point for investors seeking opportunities in this vital sector. Companies such as Impulse Space and Apex have reported substantial funding rounds recently, highlighting a shift in investor sentiment toward aerospace firms. This renewed confidence has led to increased allocations of venture capital, with startups actively seeking to meet growing market demands from both governmental and commercial clients.

In particular, the rise of space as a new frontier for defense and technology investments is noteworthy. Aerospace companies are evolving rapidly, driven by technological advancements and commercial viability. With the region’s strong talent pool from institutions like Caltech and USC, there is a robust ecosystem supporting startup growth, further piquing investor interest.

Anduril: A Leading Player in Defense Tech Investments

Anduril has emerged as a standout in the defense tech landscape, securing $2.5 billion from investors led by Founders Fund. This impressive funding round not only underscores the company’s significance but also highlights the overall trend of increasing venture capital flowing into the sector. Specifically, Anduril’s focus on autonomous weapons systems presents a unique opportunity for substantial returns on investment, as defense strategies evolve with the need for advanced technologies in active conflict zones.

The company’s commitment to innovation and expansion, evidenced by their recent contract with the U.S. Army, positions Anduril at the forefront of defense technology advancements. With continued support from venture capitalists, the company aims to leverage its resources to scale production and enter new markets, enhancing its competitive edge against established players like Lockheed Martin and Northrop Grumman.

Southern California Startups Redefining Defense Technology

Southern California has solidified its status as a leading hub for defense technology startups that are rapidly redefining what innovation looks like in the industry. Companies such as Chaos Industries and Impulse Space demonstrate the region’s diverse offerings within the defense sector. These startups are not only receiving substantial venture capital funding but are also poised to disrupt traditional practices within the aerospace and defense industries. Chaos Industries, for instance, is diversifying its innovative military radar technologies, responding to evolving security challenges.

The emphasis on technology integration among new and existing systems within the defense ecosystem is crucial as startups grow and scale. This competitive environment fosters a culture of agility and responsiveness, ensuring that Southern California’s startups can meet the defense demands of tomorrow. As the region nurtures more such companies, the potential for groundbreaking advancements in defense technologies appears limitless.

The Impact of Geopolitical Tensions on Venture Capital

Geopolitical tensions significantly impact venture capital flows, particularly in sectors susceptible to government contracts, such as defense technology. As international conflicts and security concerns heighten, investors are increasingly channeling funds into technology that promises enhanced national security capabilities. This has become evident in the rapid increase of investments in defense tech firms within Southern California, where many startups are strategically positioned to respond to increasing demand from both military and commercial sectors.

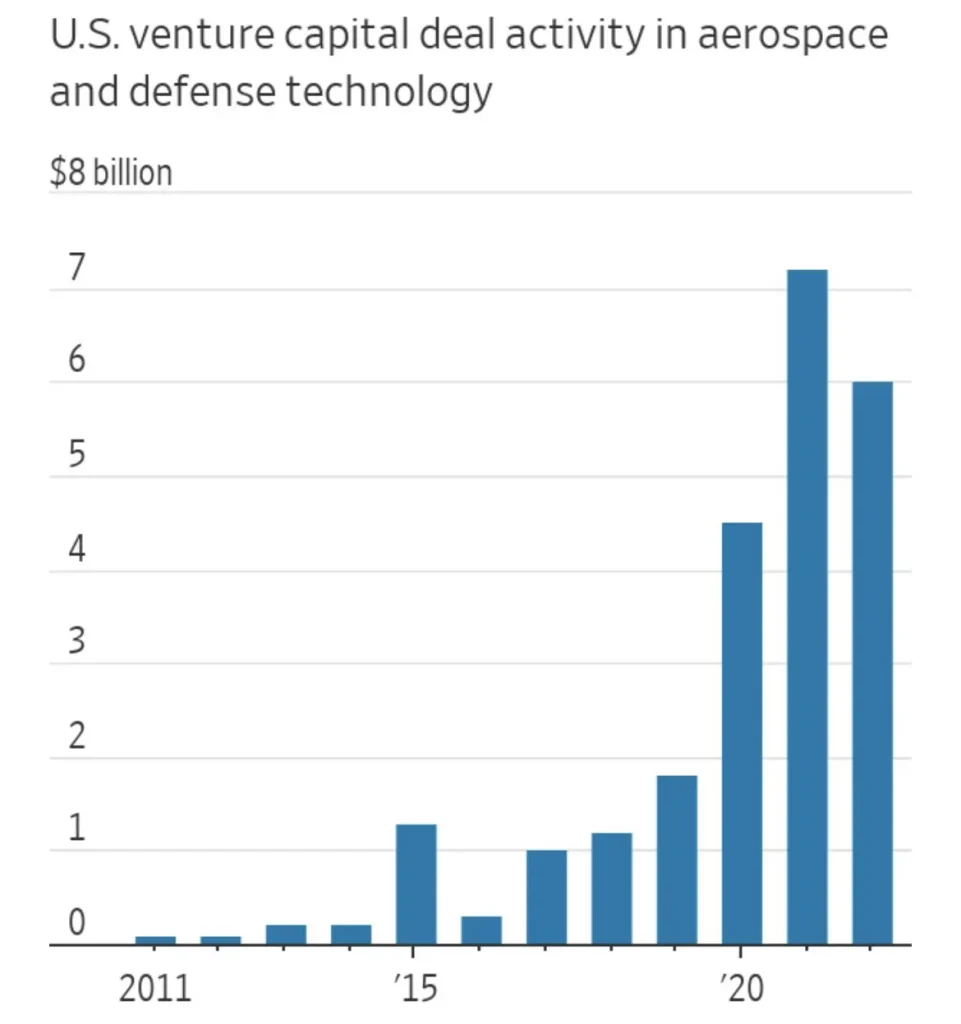

For example, venture capital activity in the defense technology sector has outpaced previous years’ totals, reflective of investor sentiment that recognizes the enduring need for innovation in defense systems. Analysts predict that as geopolitical challenges persist, the trend of investing in defense tech will remain a priority for many venture capitalists seeking to protect and bolster national security through technological advancements.

Future Trends in Defense Technology Investments

Looking ahead, the future of defense technology investments appears robust, with numerous trends set to shape the sector. As companies like Anduril and Chaos Industries emerge as industry leaders, the capital they generate can spur further innovation and attract more startups to the field. With an emphasis on advanced systems such as unmanned aerial vehicles and autonomous solutions, the landscape of defense technology is rapidly evolving to meet new challenges and opportunities.

Additionally, the willingness of investors to provide funding in light of earlier apprehensions indicates a confidence shift in the potential for substantial returns in the defense sector. With government backing driving demand, startups that can seamlessly integrate new technologies with existing systems are positioned for success. This integrative approach will become a crucial strategy as defense organizations look to navigate the complexities of modern warfare and technological demands.

The Role of Los Angeles Venture Capital in Defense Startups

Los Angeles venture capital has played a vital role in facilitating the growth of defense startups, enabling them to innovate and compete on a global scale. The city’s strategic location and connections to significant military installations and contractors offer immense advantages for startups looking to penetrate the defense tech market. This burgeoning venture capital presence in Los Angeles is leading to an increased focus on funding innovators in the aerospace and defense sectors, attracting talent and expertise to the area.

As more venture firms recognize the potential success of Los Angeles-based defense startups, the pipeline of opportunities is likely to grow. The synergistic relationship between venture capital and startups accelerates technological advancements, providing the necessary support to bring innovative solutions to market, fundamentally reshaping the defense landscape in the region.

Challenges Facing Defense Technology Startups

Despite the impressive growth in venture capital funding, defense technology startups face numerous challenges that can impede their potential. Competition among emerging companies is becoming fiercer as many vie for limited government contracts and investor attention. Given the complex procurement processes often associated with government contracts, startups must navigate a labyrinth of regulations and standards before they can make significant inroads into the market.

Additionally, the reliance on government budgets can create instability for defense tech firms during periods of fiscal tightening. Startups must cultivate diverse client bases and explore partnerships to mitigate risks associated with the volatility of government spending. By leveraging innovation and collaboration, these firms can develop sustainable business models that not only survive but thrive amid the shifting landscape of defense technology.

The Future of Aerospace and Defense Innovation

The aerospace and defense sectors are on the cusp of a transformative era, driven by advances in technology and shifting market demands. Startups focusing on drone technology, satellite communications, and artificial intelligence are expected to play pivotal roles in future conflict scenarios. As governments increasingly look to private sector innovation to meet defense needs, venture capital funding will be vital in supporting research and development efforts. This trend signifies a shift from traditional practices to a more collaborative, innovation-focused approach.

Moreover, as the global climate continues to emphasize the importance of advanced aerospace capabilities, startups dedicated to sustainable technologies may capture significant investor interest. A focus on developing eco-friendly systems for defense applications could redefine operations while appealing to a growing conscientious investor base. The integration of innovative solutions and adaptive strategies will ultimately shape the future of aerospace and defense technology investments.

Frequently Asked Questions

What trends are shaping venture capital defense tech investments in Los Angeles?

Venture capital defense tech investments in Los Angeles are experiencing a significant surge, having doubled to $5.8 billion recently. This growth reflects a strong focus on aerospace and defense technology companies, spurred by rising geopolitical tensions and government support. Firms like Anduril have emerged as major recipients of this capital, showcasing that Los Angeles is a pivotal region for defense tech innovation.

How has Anduril influenced the venture capital defense tech landscape in Southern California?

Anduril has profoundly impacted the venture capital defense tech landscape in Southern California by raising $2.5 billion in funding, positioning itself as a leader in autonomous systems. This highlights the increasing interest from investors in defense technology investments. As Anduril continues to innovate, its success encourages more venture capital firms to engage with the Southern California startups in this sector.

What role do Southern California startups play in the defense technology sector?

Southern California startups are at the forefront of the defense technology sector, with nine local companies ranking among the top 30 global recipients of venture capital financing. These firms are leveraging the region’s rich talent pool and historical significance in aerospace and defense to innovate and disrupt established players. The area’s proximity to industry leaders enhances their potential for growth and investment.

Why is Los Angeles an attractive destination for defense technology investments?

Los Angeles is an attractive destination for defense technology investments due to its established ecosystem of aerospace companies and defense contractors, substantial venture capital funding, and access to a skilled workforce from top universities. This environment fosters innovation and collaboration, making it a prime hub for emerging defense tech startups seeking to capitalize on rising defense spending.

What is the significance of government support in venture capital defense tech firms?

Government support is crucial for venture capital defense tech firms as it facilitates funding access and stimulates growth in this sector. Investors are increasingly optimistic about collaborating with defense tech startups, buoyed by government contracts and increased defense spending in response to geopolitical challenges. This backing reinforces the sustainability and expansion of companies within the defense technology landscape.

How are traditional defense contractors responding to the rise of venture capital defense tech?

Traditional defense contractors like Lockheed Martin and Northrop Grumman are responding to the rise of venture capital defense tech by focusing on innovation and potentially engaging in partnerships or mergers with startups. This response is essential to retain market share amidst new disruptions and to enhance their capabilities in line with evolving defense needs, while integrating new technologies developed by these younger companies.

What impact have recent venture capital rounds had on companies like Chaos Industries and Impulse Space?

Recent venture capital rounds have significantly boosted companies like Chaos Industries and Impulse Space, enabling them to expand operations and scale production effectively. Chaos Industries, having raised $275 million, aims to enhance its manufacturing capabilities for radar systems. Impulse Space reported rapid growth in customer demand, leveraging its funding to accelerate R&D and hire more staff, showcasing the positive ripple effect of increased venture capital in defense tech.

What future trends can be expected in venture capital defense tech initiatives?

Future trends in venture capital defense tech initiatives are expected to include increased funding for autonomous systems, enhanced emphasis on cybersecurity, and advanced aerospace technologies. As geopolitical concerns continue to rise, investors are likely to prioritize innovative solutions that address these challenges, with Southern California emerging as a focal point for new startups and significant VC investments.

| Key Point | Details |

|---|---|

| Venture Capital Growth | Venture capital investments in Greater Los Angeles have surged to $5.8 billion in Q2 2025, more than doubling from the previous year. |

| Anduril’s Funding | Anduril, a defense tech company, raised $2.5 billion to enhance production and capabilities. |

| Importance of Defense Tech | Investors are increasingly focused on defense tech due to rising geopolitical tensions and government support. |

| Local Companies’ Performance | Southern California companies include nine of the top 30 privately held defense tech businesses attracting venture capital. |

| Startups on the Rise | New startups in defense tech are taking market share from established companies like Lockheed Martin. |

| Major Players | Anduril led funding followed by Impulse Space ($300M), Chaos Industries ($275M), and Apex ($200M). |

| Market Demand | There’s high demand for defense tech innovations, with startups scaling to meet government contracts. |

Summary

Venture capital defense tech is witnessing unprecedented growth, particularly in Southern California, a region known for its rich history in defense and aerospace industries. The increase in funding reflects a strong investor interest in leveraging advanced technologies to address vital national security concerns. With major players like Anduril leading the charge in innovation and funding, the landscape for defense technology is rapidly evolving, and new startups are emerging to capitalize on opportunities in this critical sector.